Rationale & Benefits

Why Use Capnote?

Digitization is an unstoppable global force that’s changing finance & investing. There are new asset classes like cryptocurrency. There’s exponentially more data to consider for good financial decision-making. In fact, better financial performance is directly correlated to data processing capabilities. Modern digital experiences are also more important for the next generation of financial customers & professionals.

To remain competitive, businesses, professionals & investors need help leveraging modern technology & digital assets. The vast majority are underserved by legacy tools which have not evolved with the times. Read more below to discover how Capnote can help you achieve more, earn more and save time. Book a free discovery call to discuss your specific needs.

Empowerment Financial Advisors

Ex-Goldman Sachs Banker

Increase Productivity & Save Time

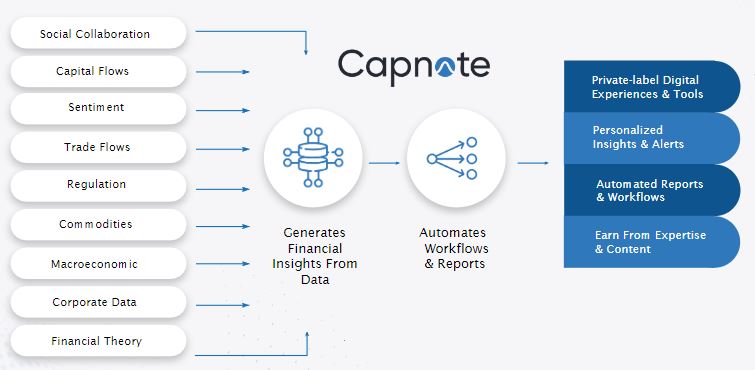

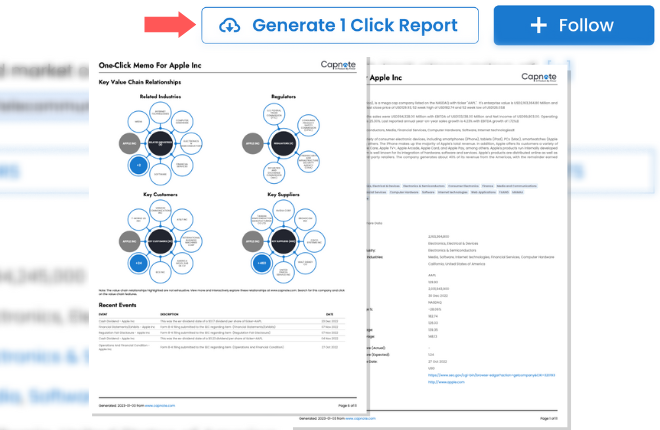

Capnote uses proprietary patented technology to offer Financial- Processing-As-A-Service. This automates the management & processing of financial data and end-use workflows. For example, Capnote’s one-click report function can save up to two weeks worth of time, reducing hours of manual report writing and data entry into a single click. This allows professionals and teams to get more done.

Earn More Income

Capnote can help organizations and individuals make more money in a variety of ways. Organizations can create monetizable digital experiences that customers can be charged for. Independent providers and creators can work with Capnote to sell proprietary data and expertise. Click below to read an illustration of how Capnote can help a trading company earn more income and generate annualized ROI above 50%.

Lower Costs

Accenture estimates the financial industry in North America can generate $140 billion in cost savings from better technology for automation and augmentation. Naturally, this also applies across the rest of the world as well. Capnote helps organizations and professionals tap into these benefits by automating workflows, sourcing data and research from independent providers at a lower cost and allowing more flexible subscriptions.

Improve Risk Managment

Capnote helps organizations and professionals aggregate data from a broad range of sources, process the data to discover insights and automate end-use workflows such as report writing. In addition, custom alerts and algorithms can be set-up on Capnote to factor in your specific risk appetite or methodology. These have all been designed to reduce information asymmetry and help risk management processes be run more efficiently.

Enhance Digital Experiences

Capnote can be utilized by organizations on a private-label basis to create custom digital experiences for customers and internal teams. Better digital experiences are critical to customer attraction and retention, particularly for younger generations. However, financial organizations do not typically build innovative technology well. Click below to read more about how Capnote can accelerate digital transformation with an illustration.

Empower Your Financial Success Today

Click below to schedule a free discovery call to discuss your needs and discover how Capnote can benefit your organization.