These 5 Lessons Limit Financial Losses From Supply Chains

Following the pandemic, we all understand that global supply chains are integral to business, finance and our daily lives. The interplay between financial risks and supply chain management was particularly emphasized during the global financial crisis of 2007-08.

In this article, we list 5 lessons that can help limit financial losses from supply chains disruption in your portfolio or company.

Capnote is an AI-powered financial platform that can help you identify and manage financial risks in supply chains. Watch a demo video below and try for free at www.capnote.com.

Limit financial losses from supply chains disruption by using the below lessons learned from the global financial crisis.

1. Take Time To Understand Your Exposure & Concentrations.

Most of us don’t know the true extent of the financial, geographic or operational exposure we face. In an increasingly interconnected world, even seemingly distant events can have impactful ripples. Companies you invest in may also be simultaneously involved in multiple industries, each with their own characteristics and risk profile.

Capnote helps by constantly aggregating data and identifying common suppliers, customers, industries, geographies and tags that apply across a portfolio. Try for free by signing up, building a portfolio and clicking on the sensitivities button. A sample extract is below.

Capnote helps by constantly aggregating data and identifying common suppliers, customers, industries, geographies and tags that apply across a portfolio. Try for free by signing up, building a portfolio and clicking on the sensitivities button. A sample extract is below.

2. Don’t Underestimate Unexpected Volatility Of Commodities or Currencies.

Prices of commodities and currencies are impossible to control or predict. Market dislocations can happen suddenly without much warning. During the financial crisis, fluctuations in currency exchange rates, exposing companies to financial losses on international transactions and contracts denominated in different currencies.

Capnote helps you observe gradual changes in volatility for commodities and currencies by constantly calculating 5 year price averages and standard deviations in a moving window. It then notifies you about changes in levels based on pre-set thresholds. See the below screenshot and watch a demo video to learn more.

Capnote helps you observe gradual changes in volatility for commodities and currencies by constantly calculating 5 year price averages and standard deviations in a moving window. It then notifies you about changes in levels based on pre-set thresholds. See the below screenshot and watch a demo video to learn more.

Also Read; Here Are Top 3 Money-Making Data Post This Week

3. Risk Management Should Be Proactive & Continuous.

Businesses and investors should constantly monitor liquidity and credit worthiness within supply chains. Those that had robust risk monitoring mechanisms in place were better equipped to navigate the financial crisis. Flexible scenario planning that anticipates various financial scenarios and develops contingency plans can be a life saver.

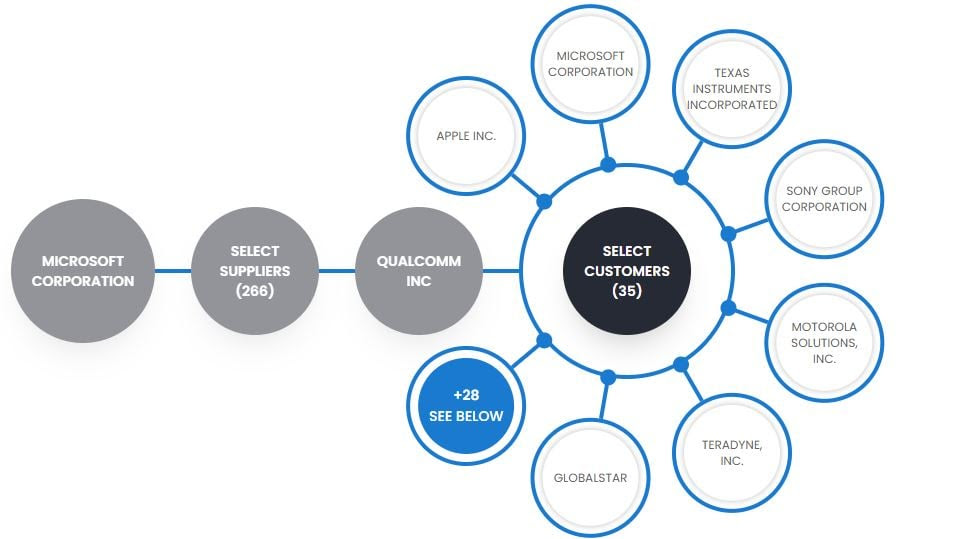

Capnote constantly aggregates data and monitors financial risks of companies in our supply chain. This is particularly helpful as most people cannot afford to hire huge teams of analysts to constantly monitor large and diverse supply chains. As an example, in the below extract, Capnote identifies 286 suppliers of Microsoft and 35 large customers of Qualcomm. It tracks the financial metrics for all of these companies so you don’t have to.

Capnote constantly aggregates data and monitors financial risks of companies in our supply chain. This is particularly helpful as most people cannot afford to hire huge teams of analysts to constantly monitor large and diverse supply chains. As an example, in the below extract, Capnote identifies 286 suppliers of Microsoft and 35 large customers of Qualcomm. It tracks the financial metrics for all of these companies so you don’t have to.

4. Invest in Technology To Help.

Advancements in technology, such as early warning systems, AI-powered analytics, data aggregators and blockchain for supply chain transparency are transforming risk management practices. These innovations provide greater visibility into supply chain operations and enable proactive risk mitigation such as contract renegotiation or portfolio diversification.

To get insight into a company’s performance and priorities, the financial statements and its peer group comparisons will provide you with data that management uses for decision-making. Take a look at Capnote’s Algo-Notes tool for automated notes generated from processing the financial statements and peer comparisons.

To get insight into a company’s performance and priorities, the financial statements and its peer group comparisons will provide you with data that management uses for decision-making. Take a look at Capnote’s Algo-Notes tool for automated notes generated from processing the financial statements and peer comparisons.

5. Good Relationship Management Is Essential.

Companies, investors and advisors that maintain beneficial communication channels are more likely to collaborate effectively during times of crisis, mitigate disruptions and find mutually beneficial solutions. To do this effectively, it is important to understand the other party’s business motivations, strategies and priorities.

In conclusion, the global financial crisis serves as a stark reminder of the vulnerabilities inherent in interconnected supply chains and the imperative of proactive financial risk management. Businesses, investors and capital providers that understand these lessons stand better prepared to navigate future disruptions.

In conclusion, the global financial crisis serves as a stark reminder of the vulnerabilities inherent in interconnected supply chains and the imperative of proactive financial risk management. Businesses, investors and capital providers that understand these lessons stand better prepared to navigate future disruptions.

Fun With Financial Literacy For Kids

In between creating financial algorithms, the Capnote team had some fun writing a short story to help kids learn about money. What Is Money – A Story For Kids, is the first part of a media series created by Finvar with the aims of promoting financial literacy at younger ages. It’s perfect for parents, educators and caregivers interested in sharing teachable lessons with children in a fun and safe way. It also makes a great gift idea!