Solutions

Improve Risk Management

There’s too much data for any of us to track and use effectively without the right technology. Capnote helps you constantly connect the dots so you know more and risk less.

Many financial and investment managers often don’t realize the exposure they are faced with until it’s too late.

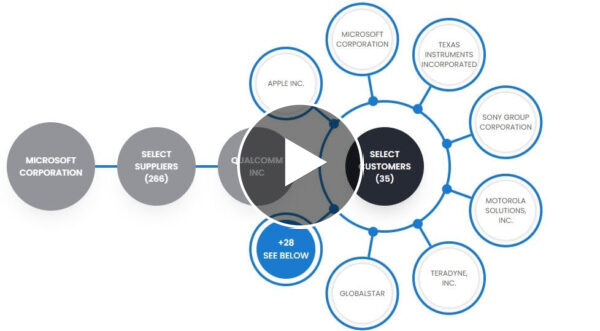

For example, you really should know if a lot of the companies in your portfolio rely on products from the same supplier or manufacturer. Without the right technology, it’s virtually impossible to identify portfolio concentrations across multiples factors such as industries, suppliers, customers or commodities.

Capnote uses big data and neural networks to help you identify concentrations and risks in your portfolios. You’ll even be able to track custom tags matched to characteristics of companies or assets.

The best financial & investment managers know when there’s a commodity price dislocation in any market. It can create risks and knock-on effects that may be difficult to spot. However, there’s way too much data for any of us to track effectively without the right technology – especially if you don’t have a huge team of analysts.

Capnote constantly keeps you aware by tracking the long term averages and volatility for 70+ commodities and indicators as well as prices of stocks and cryptocurrency. You can even receive smart alerts when key levels change based on your risk appetite.

Testimonials

Here is what our users are saying…

Increase Your Financial Productivity Now

Join a growing community with thousands of financial professionals and investors from all over the world.