Overview

An Introduction To Capnote

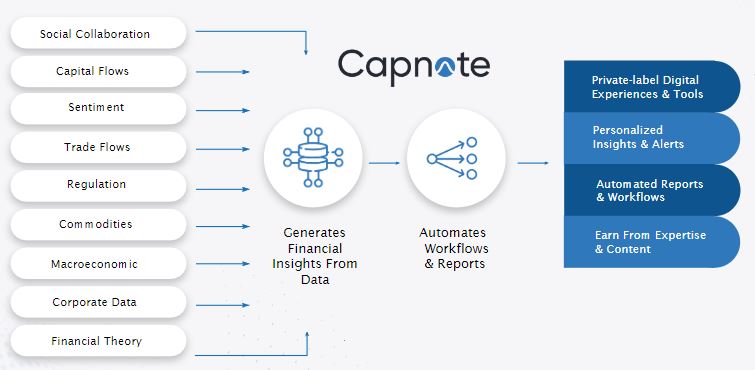

Created by financial professionals for financial professionals, Capnote is an AI-powered operating system for financial data management & processing. It leverages patented technology & A.I to empower the financial success of organizations & professionals – who now have too much data to process and not enough time or resources.

Capnote’s founders have 80+ years of combined professional experience from working in the banking, hedge fund & technology industries. They recognized that unstoppable trends of digitization & globalization are making finance faster & more complicated than ever. As such, financial performance is significantly linked to data processing capabilities.

To remain competitive, financial organizations must also provide customers & internal teams with cutting-edge digital experiences. Don’t get left behind! Read more below to discover how Capnote helps financial organizations & professionals save time & cost, discover new insights, earn more money and accelerate digital transformation.

Rand Merchant Bank

Empowerment Financial Advisors

Publicly Listed Companies

Industries

Indicators & Commodities

Years of Historical Data

Supply Chain Relationships

Institutional Investor Chain

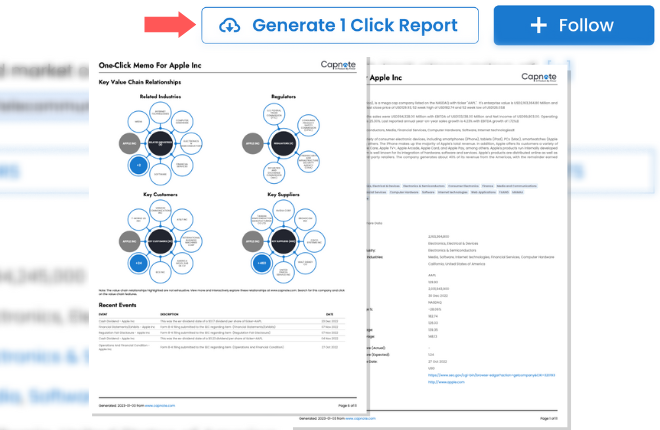

Financial Processing As A Service

Improve productivity, save time & lower costs by automating the workflows required to generate financial value or content from data. Capnote can be configured to work with publicly available data or securely with private data. Workflows and algorithms can be used with default settings or customized so you get the output and format that you require.

Accenture estimates the financial industry in North America can generate $140 billion in cost savings from automation and augmentation. This also applies across the world. Use Capnote to realize these synergies.

Accelerate Digital Transformation

Customize Capnote on a private-label basis to create new digital experiences. It’s common knowledge that financial organizations struggle to build technology efficiently. For example, McKinsey estimates that 70% of banks fail at digital transformation with projects going over budget and not achieving objectives.

Book a discovery call to find out how we can help you beat the trend. Use Capnote on a private-label basis to reduce cost, accelerate project completion and earn more income.

Data Sourcing & Enrichment

By processing large amounts of data, tracking multiple indicators and continuously being updated with more financial theory, we are improving the quality of work and bridge gaps in education or expertise.

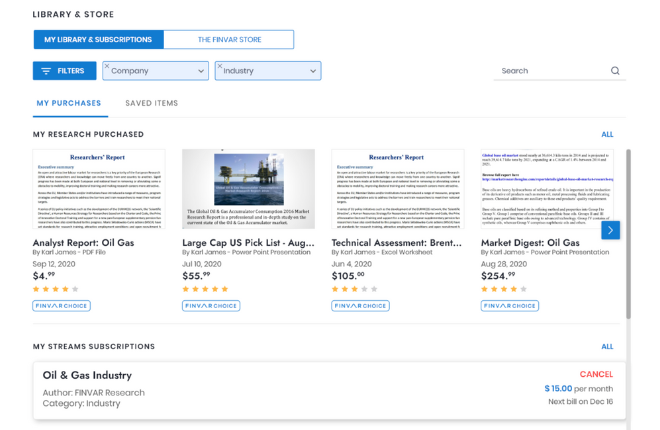

Monetize Data, Content & Expertise

The best organizations and investors have unlimited access to experts and their custom content. Capnote has been designed to help those without such access benefit from similar expertise.

Increase Your Financial Productivity

Get started with Capnote and join a growing community with thousands of financial organizations and professionals from all over the world.